Let's look at safety tips for cycling.

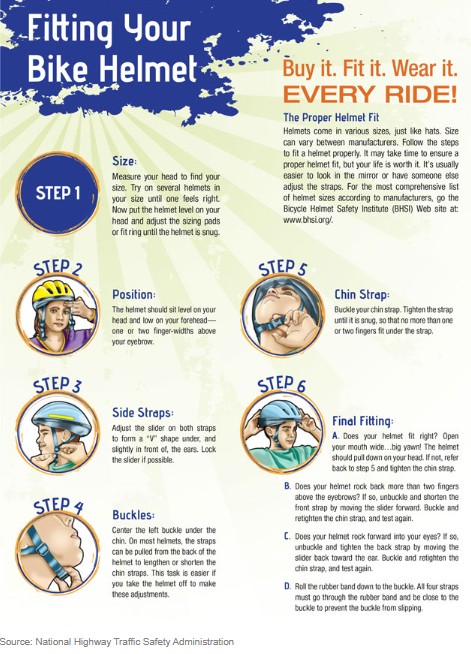

1. Wear a Helmet

Research shows that wearing a helmet can reduce the risk of a serious injury by 70 percent. Head injuries are the leading cause of fatal bike accidents. Unfortunately, 97 percent of victims do not wear helmets. Simply wearing a helmet can prevent many unintentional bike deaths.

2. Check Your Equipment Before You Ride

Bicycle equipment malfunctions contribute to a significant number of crashes. You can reduce the risk of an equipment-related accident by checking your bike, helmet, and gear before you hit the road.

Make sure your tires are properly inflated. Check your reflectors and lights to make sure that they’re working. Inspect your chains and gears for any defects, fractures, or issues. These simple steps can prevent an accident that could change your life.

3. Wear Reflective Materials

A leading cause of bike accidents is limited visibility. If a driver cannot see you, an accident is more likely to occur. This is particularly true at intersections when your paths are likely to cross. While installing reflectors on your bike can help, it’s also important to wear bright and/or reflective clothing. Increasing your visibility will reduce the risk of a bike accident.

4. Keep Your Hands on the Bike

You may have a great sense of balance but think twice before riding hands-free, particularly when you’re sharing the road with other vehicles. If your hands aren’t on the bike, it will take you much longer to react to unexpected circumstances, such as a pedestrian in your path or debris in the road. As a result, you’re more likely to either fall off of your bike or cause an accident because you cannot brake in time.

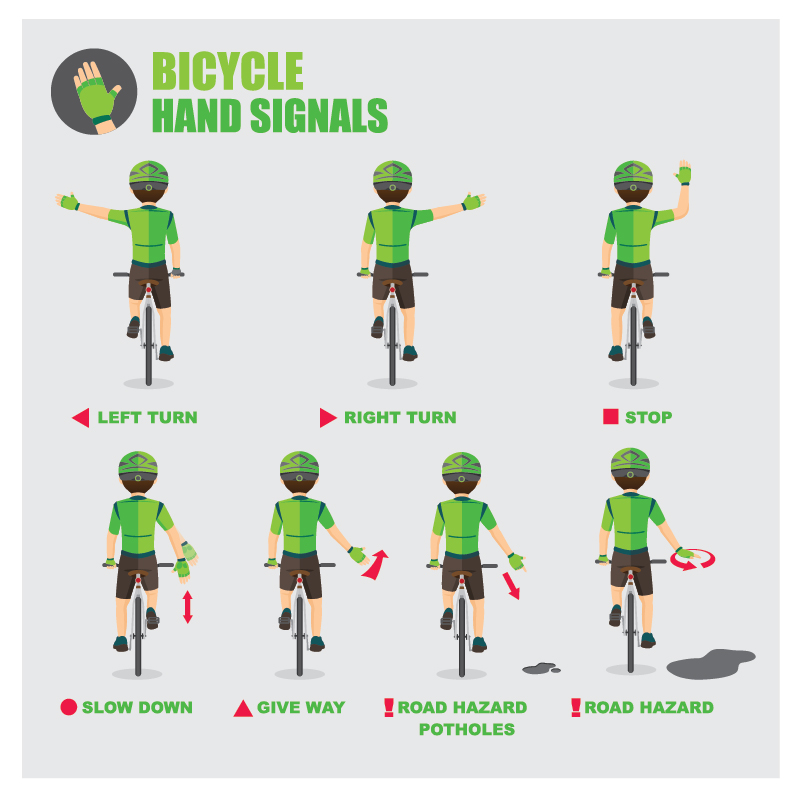

5. Know Your Signals and Use Them

It’s important to make sure that you’re fully familiar with bike hand signals. You need to be able to communicate with nearby drivers and other cyclists. A driver cannot anticipate what you’re going to do unless you provide fair warning. Make sure that your hand signals are obvious and clear to others. For a detailed description of hand signals, refer to Basic Bike Hand Signals.

6. Limit Your Distractions

It can be dangerous to ride a bike while distracted. In fact, since you’re already more vulnerable to serious injury and death, distracted cycling can be even riskier. Take full advantage of your bike ride by stashing electronics in your bag or pocket. If you need to drink, opt for a water bottle that’s easy to operate with one hand. Keeping your eyes on the road and tuning into your surroundings will help to keep you safe.

7. Ride As If You’re In a Car

You may be able to reduce the likelihood of an accident if you act like you’re driving a car. Studies show that drivers become used to the patterns and behaviors of vehicles on the road. Cars don’t weave in and out of traffic, ignore traffic signals, or cut across multiple lanes at once. When you ride a bike, it’s easier to do these things. However, you’re more likely to catch a driver by surprise or limit your visibility when you do. Keep yourself safe by riding predictably and mimicking the behaviors of larger vehicles whenever appropriate.

8. Ride With the Flow of Traffic

Always ride your bike with the flow of traffic (travel in the same direction as other vehicles on the road). Accidents are much more likely to happen when you go against the grain. If an accident does happen when you’re riding against the flow of traffic, you’re more likely to be at fault for the crash.

9. Stay Off of the Sidewalks

Sidewalks may seem like a safe alternative when you’re riding alongside larger vehicles. Sidewalks belong to pedestrians. You’re more likely to crash into a pedestrian or lose control when the sidewalks are crowded. Sidewalk pavement is more likely to be uneven than asphalt on the road. You can hit a crack or bump in the sidewalk and go flying. Cars don’t expect to see a bicyclist enter the road from a sidewalk. You’re more likely to take a driver by surprise and get hit when you use the sidewalk. Remember, drivers are used to behaviors of other cars.

10. Use Dedicated Bike Lanes

An increasing number of cities and municipalities across the country are embracing dedicated bike infrastructure. However, protected bike lanes can only keep you safe if you ride in them. Whenever you see a bike lane, make sure to use it.