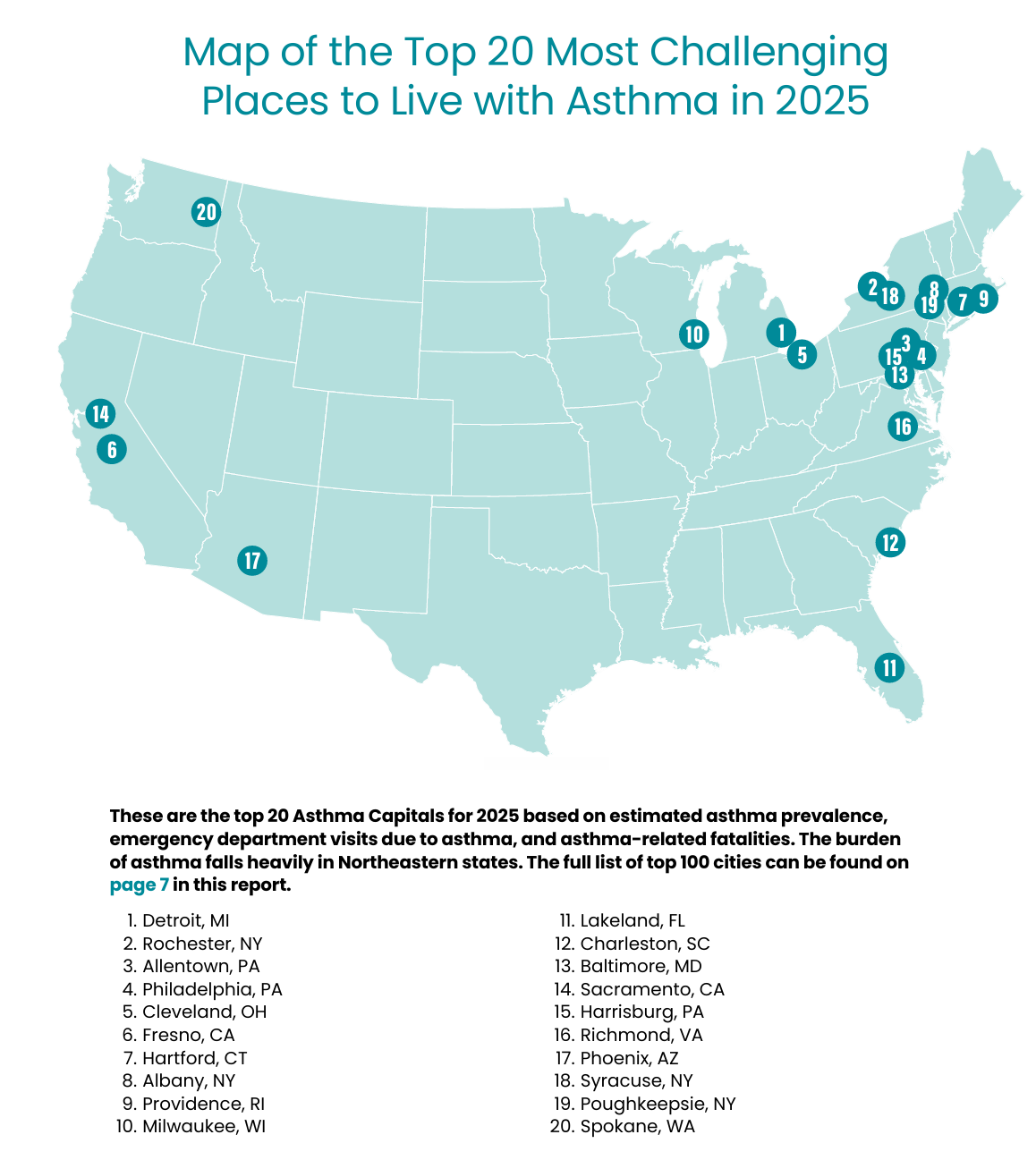

The Asthma and Allergy Foundation of America’s Asthma Capitals™ report ranks the largest 100 cities in the contiguous U.S. by how challenging they are to live in when you have asthma. Yes, Detroit is number one (source AAFA Capitals Report)

Why Is Asthma Worse in September?

People with asthma and allergies are exposed to several triggers in September. Weed pollen, especially ragweed, the most common fall pollen allergy, is highest in September in the United States. Mold counts go up as leaves collect outside. Children return to school and may catch respiratory infections. Extreme weather and wildfires are also a contributing factor. Flu and cold season is starting too.

How Can I Manage Asthma During September (and all year long)?

The best way to deal with asthma attacks is to prevent them before they begin. If your asthma is not under control, talk with your doctor as soon as possible.

- Follow your Asthma Action Plan to keep your asthma under control. If you do not have one, click here to get started: Asthma Action Plan.

- Schedule an appointment with your doctor or asthma specialist. Be ready to talk about current symptoms, medicines, and triggers.

- Take your asthma medicines as prescribed by your doctor.

- Get your vaccines. They take about 2 weeks to take effect in your body, so get them as soon as they are available. Yearly vaccines are usually available in September.

- Take steps to avoid getting sick. Wash your hands often and for at least 20 seconds. Avoid touching your eyes, mouth, and nose, especially during cold and flu season. Stay away from people who are sick as much as possible.

- Wear a mask. When respiratory illnesses are spreading, wear a good-fitting N95 mask in crowded indoor spaces. Also wear N95 masks if wildfire smoke is in your area or if you are cleaning up after a natural disaster or flood. Masks can also help if you have pollen or mold allergy.

- Good ventilation and air filters can improve your indoor air quality (IAQ). HEPA-certified air cleaners, HEPA filters on your HVAC system, exhaust fans, and open doors/windows can improve the air in your indoor spaces.

- If you are allergic to ragweed or mold, try to limit your exposure to those allergens.

- Take care of your health. Adequate sleep and water, a healthy diet, and exercise are important. Keep your stress levels down.

How can I make my home asthma-friendly?

- Keep windows and doors shut during high-pollen times of the year, including Peak Week.

- Ask everyone to take their shoes off before coming inside.

- Keep your hair covered outside.

- Shower and wash your hair before bed.

- Use a HEPA filter in your HVAC system.

- Pay attention to air quality reports if pollution or smoke triggers your attacks.

- Avoid asthma triggers such

Tobacco: Declare your home smoke- and vape-free. Do your best to ensure no one smokes near you or in any place you spend a lot of time.

Dust mites: Dust mites thrive in humid environments, so keep humidity low. Use a vacuum with a HEPA filter regularly on floors, rugs, and carpets, and wash and dry your bedding thoroughly.

Pests: Store food and trash in sealed containers. Clean dishes and food messes right away. Use pesticides as directed, but avoid foggers, as they can trigger attacks.

Mold: Dry wet items promptly and properly and consider using a dehumidifier. Fix water leaks, which can allow mold to grow in hidden places. Avoid harsh cleaners as they can trigger an attack.